17 January، 2023

17 January، 2023

ابحاث السوق

ابحاث السوق

Views

: 878

Views

: 878

he Central Bank of Japan will announce the results of its meeting held since this morning, tomorrow morning, Wednesday, in the Asian session, to announce its monetary policy for the coming period and interest rates, as expectations indicate that the bank may adjust once again the yield ceiling for Japanese government bonds to 0.75%.

The Bank of Japan surprised the markets at its last meeting at the end of December of last year and adjusted the yield ceiling for Japanese government bonds for ten years and allowed the yield to fluctuate up to about 0.50% higher or lower compared to its previous target of -0.25% in an unexpected move for the markets in a similar process.

By raising interest rates, which opened the door for the bank to abandon its facilitative policy. Last week, Japan announced an increase in the inflation rate in Tokyo to 4% in December from 3.6% in November, the largest rise since 1982, exceeding expectations that indicated a rise to 3.8%.

On the other hand, the yield on Japanese government bonds for ten years rises above the latest target of the Bank of Japan, to trade at its highest level in eight years at 0.530% since the end of last week until the moment, prompting the Bank of Japan to spend nearly 10 trillion yen on bond purchases to stop the rise this week. And about 2 trillion yen on Monday, to exceed the total spending of the Bank of Ja

pan 30 trillion yen of purchases since the ceiling was set on the 20th of last December.

This meeting is considered to be the penultimate one for the Bank’s president, Kuroda, after ten years in his position as Governor of the Bank of Japan, as Kuroda will step down from his post in next April, with it not being clear who will succeed him until the moment.

With the recent rise in bond yields, it is not excluded that we will witness an intervention by the Central Bank of Japan or a hint at its meeting tomorrow, Wednesday, and approaching another step towards exiting the yield control policy, especially since the official inflation figures from Japan, which will be issued at the end of this week, Friday, are expected to rise to 4. % in December compared to 3.7% in the November reading, which are much higher numbers compared to the bank’s target of 2%.

Some expectations indicate that the bank may raise the ceiling of the 10-year return again to 0.75% or even 1%, while some expectations indicate that the bank will completely abandon the yield curve policy.

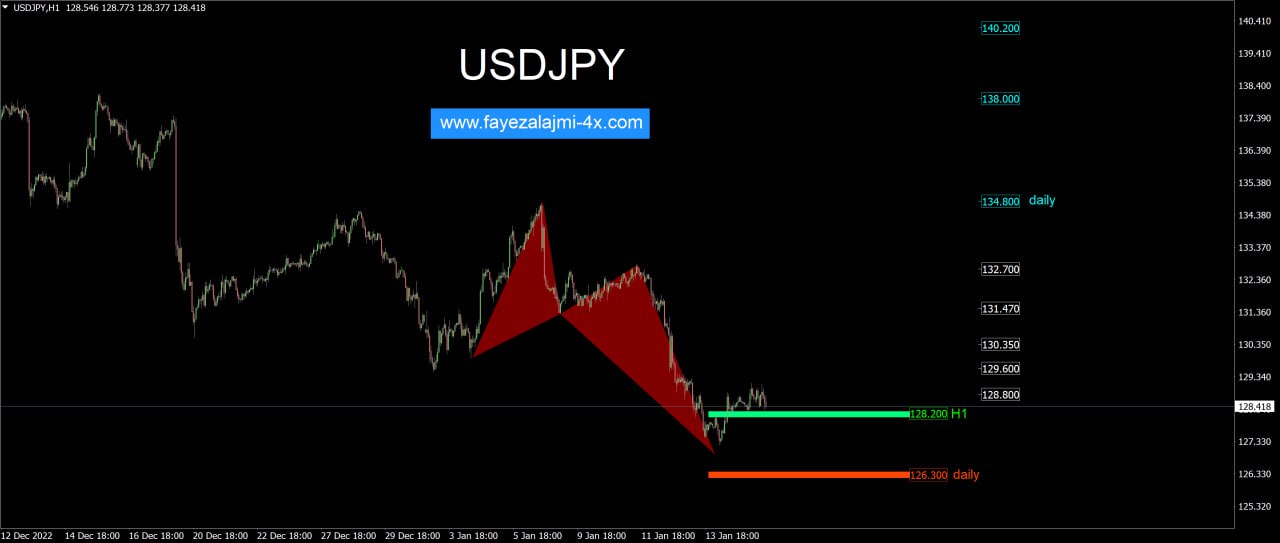

The movements of the Japanese yen will be based on the decisions of the Japanese central bank and the statements of the bank’s governor, Kuroda, as it is expected that the Japanese yen will rise strongly in the event that the ceiling for bond yields is raised to 0.75% or 1%, or the bank abandons its policy of governing the yield, and the Japanese stocks will decline strongly.

Not changing monetary policy and the tendency to monitor the December decisions of the Bank of Japan are not expected to have a strong impact on the yen’s movements, and attention will be directed towards the Bank’s president’s press conference